In the first two parts of The 5 Trillion Dollar ‘Agency Problem’, we explored the paradox of the United States’ healthcare expenditure and outcomes. Despite spending nearly $5 trillion in 2023 (ticking towards 5.4 in 2025), equating to about $14,000 per person, the U.S. continues to lag behind other developed nations in key health metrics.

We examined the financial flow within the healthcare system, revealing that no single entity—patients, doctors, hospitals, or insurance companies—appears to be profiting as commonly perceived. Doctors often face substantial student loan debts and under-compensation; hospitals struggle with thin margins; insurance companies contend with unpredictable expenses; and patients bear significant out-of-pocket costs.

In Part 2, we delved into the health insurance system’s intricacies, highlighting challenges such as the declining enrollment of healthy individuals, increasing chronic conditions, and the resulting unsustainable premium hikes. We introduced the Agency Problem, where misaligned incentives between insurers (agents) and patients (principals) lead to decisions that prioritize organizational profits over optimal patient outcomes.

These insights set the stage for Part 3, where we further analyze the systemic issues and potential solutions to address the agency problem in U.S. healthcare.

The Evolution of the Agency Problem

How did the agency problem evolve over the years and wreak havoc on the healthcare system?

I am not blaming the insurance companies—they exist for a reason. But over the years, with so many players (or agencies) in the system prioritizing their own interests, things have undeniably gone wrong.

There are many reasons why the healthcare reimbursement cycle became this convoluted. Let me break down one major issue that has snowballed over the past fifty years.

As more patients got sicker, hospitals started claiming more reimbursements from insurance companies (aka payers). This eroded the bottom line of the payers. Naturally, the CEOs of these insurance companies were pressured by stockholders to improve profitability. Now, what do they do? These executives, despite their high salaries and prestigious MBAs, boiled their strategy down to two fundamental ideas—something even a high schooler could come up with:

- Increase revenue – Collect more money from patients via insurance premiums, deductibles, and copays.

- Reduce costs – Pay less to hospitals and doctors making reimbursement claims on behalf of patients.

But raising revenue isn’t so easy. The healthcare market is not a monopoly (thankfully), but rather an oligopoly—where a few big players compete for the same pool of patients. And then there’s Uncle Sam, keeping an eye on unfair practices. If a payer goes overboard in squeezing the public, the government steps in. So increasing revenue isn’t always a straightforward option.

That left CEOs with just one way to boost their bottom line—pay hospitals and doctors less.

How to Pay Less?

Faced with this challenge, payers started looking for ways to cut reimbursement costs. First, they took a fair approach: questioning whether a medical procedure was truly necessary.

Here’s a layman’s example. The insurance company could look at a claim and say, “Do you really need an expensive CT scan for this? Wouldn’t an X-ray suffice?” The hospital and doctor would push back, “No, this medical case requires a CT scan. Using an X-ray instead could result in a wrong diagnosis.” At least this was a reasonable debate.

Initially, insurers didn’t have enough medical expertise to argue back effectively, so they had to listen to the doctors. But when denials became more common and providers started fighting back more aggressively, payers realized they needed a stronger defense. Their solution? Hire doctors of their own to justify claim denials!

When Fair Approaches Were Not Enough

The back-and-forth of claim denials and appeals continued. Insurance companies soon realized that fighting reimbursements after the medical treatment was completed was too late in the cycle. Why not get ahead of the game? Enter Payer-Provider Contracts.

Payers began negotiating contracts with providers to set lower fees for services upfront. The larger the provider—say, a big university hospital—the better rates they could negotiate. Smaller clinics down the street? They got squeezed. Payers knew they had more power over smaller providers, and they used it.

But that still wasn’t enough. Insurance companies had to get even more creative in denying claims. So they started rejecting claims over the tiniest clerical errors.

Welcome to the World of Paper and Electronic Claims

Let me translate this in layman’s terms. A payer would say, “This claim says a certain procedure (industry lingo: CPT code) was performed for a specific diagnosis (industry lingo: ICD code). These two codes don’t add up.” The provider would respond, “Oh, that was an error in medical coding. Let me fix it by changing the CPT code from X to Y.” The claim would go back to the payer.Then the payer would scrutinize the claim harder. “Oh, but the CPT code is missing a modality!” (For example, a hand X-ray should specify whether it was lateral, frontal, or oblique.) The provider sighs and fixes it again. This endless back-and-forth is exhausting—especially for small clinics, many of which eventually give up on getting reimbursed at all.

Can Medical Coders Save the World?

Enter medical coders—specialized professionals trained to navigate this mess. These are not doctors or healthcare providers; they are highly trained in coding nuances, knowing which payer rejects what claim for which silly reason. Their job? Fight the insurance companies over these denials.

It’s ridiculous, isn’t it? We started this discussion with doctors treating patients, and now we’re talking about a whole industry built just to argue over paperwork.

49 Cents Reimbursed for Every Dollar Claimed

Here’s where it gets crazier: Only 49 cents of every dollar claimed is actually reimbursed.

When I was a child and needed money for a school outing, I knew my mom would give me only $2 if I asked for $4. So what did I do? I asked for $8! That way, I’d end up with the $4 I actually needed. Hospitals play the same game now. If they expect only half of their claim to be reimbursed, they just double their charge.

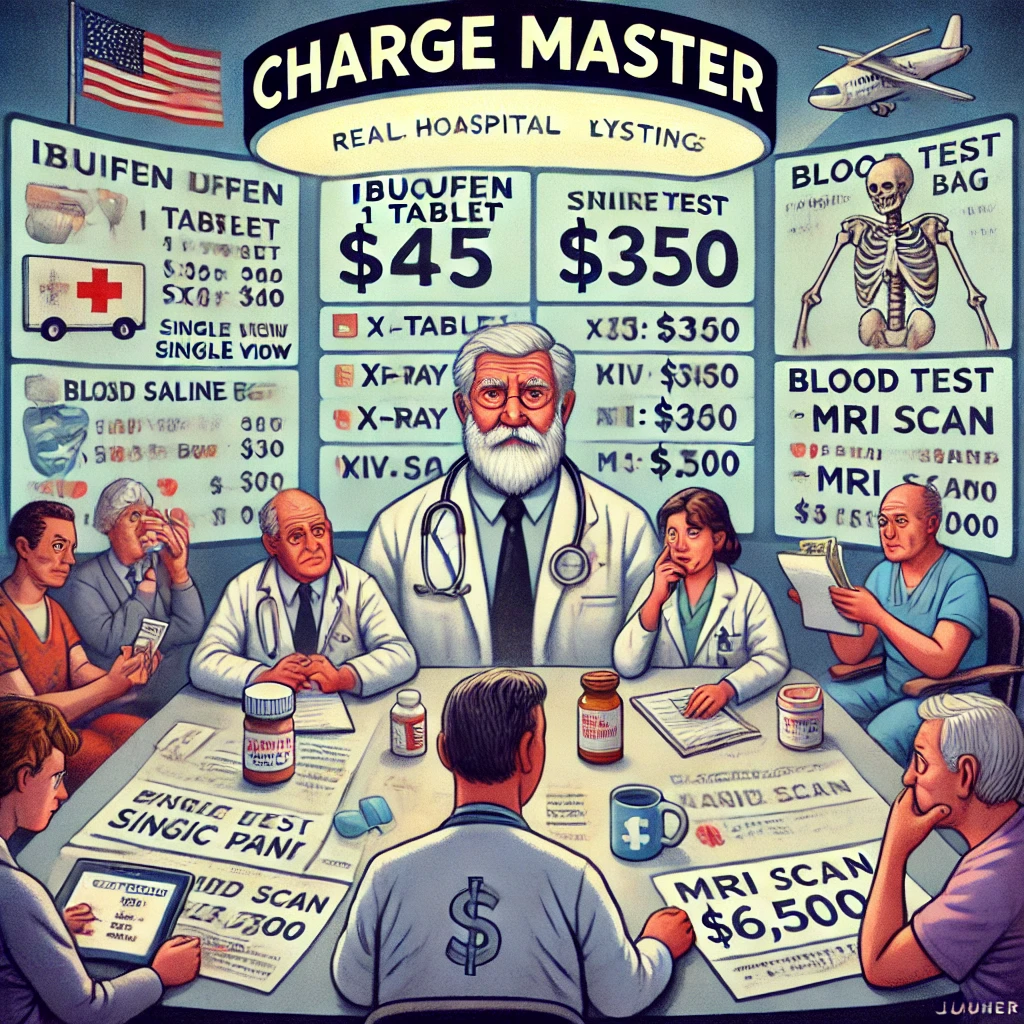

The Charge Master and Inflated Healthcare Costs

This is how we got the infamous Charge Master—a hospital’s pricing list for medical procedures, treatments, and medications. When I was working on a hospital software implementation in Georgia, I came across a Charge Master listing ibuprofen at $45 per tablet. I assumed it was a software error, thinking someone forgot to put a decimal point. Nope—it was real! Not $0.45 per tablet, but $45! I thought there was no logic to this—it’s not going to cost that much even if the nurse were to bring it from the pharmacy to the patient’s bedside on a forklift truck!

I am pretty sure early on in the healthcare claims reimbursement cycle (aka Revenue cycle), the payers were reasonable. So, if a hospital claimed that they spent $100 on treating a patient, the payer would say, ‘ah, this extra night stay was unnecessary so i am going to pay you only $90’. I am sure at first things followed logic and reasoning. So, the hospital would have said,’Ok from next time, a patient like this visits the hospital, let us discharge one day earlier’. This approach would have reduced the healthcare spend. But over a period of time these denials went crazier and crazier and followed no logical reasoning. So the hospitals started behaving like my 10 year old self and used the logic ‘If the payers are going to deny 50% of what I claim, I will simply claim twice the cost’. And here we are today with an inflated fictional pricing in charge master.

Conclusion: Can We Fix the Agency Problem?

The healthcare system is spiraling deeper into inefficiency. At a recent healthcare IT conference, I saw AI being used to fight claim denials—yet another sign that more effort is going into reimbursement battles than into patient care.

Unfortunately, developing countries like India are following the same broken path. Once a simple system where patients paid providers directly, insurance reimbursement is now becoming the dominant model—with all its associated problems.

Fixing the system is not easy, and there is no single silver bullet. But one place to start is clearly the Charge Master. It’s time to dismantle the financial mechanisms that fuel this madness.

As Sherlock Holmes might say, “Elementary, my dear Watson.”

Discover more from Sudhakar's Musings

Subscribe to get the latest posts sent to your email.

An article that helps us think through all the workflows and gives it very different perspective. Something so elementary has been wrapped up with so many layers. As we peel it, the mystery unfolds!!!

Patient paying provider was the best system ever. A whole middleman is thriving at the cost of genuine patient care. Good post Sudhakar.